Showcasing the transition to tech: Meera Sundaramurthy

From the world's largest asset manager to cutting edge developments in payments

Edited for brevity and clarity

Hi Meera, thanks for joining us today. Can you talk us through your career progression?

After graduating from NYU, I joined BlackRock as part of the New Graduate Analyst program in NYC. I spent nearly four years at BLK in the Aladdin business. I was initially a Product Analyst and then moved to San Francisco to support the firm's strategic clients on the West Coast. Toward the end of my fourth year, I resigned and moved to India to be a Volunteer Teach at Shanti Bhavan's Children Project. It's gained even greater popularity since being featured on Netflix, but I joined as an educator teaching disadvantaged children essential skills like math. I spent months in India and then eventually returned to San Francisco.

After BlackRock and Shanti Bhavan, what came next?

At that time, I knew I wanted to transition to FinTech. I felt that my experience at BlackRock and in the Aladdin business best lent itself to that, and on a personal level, I found it most interesting. I had studied Computer Science and Economics at NYU and wanted to use my background in both of those areas.

Where did you go and how did you decide?

I decided to join Brex! Frankly, it was their guerilla marketing that got me. I saw an ad for "7x points on Uber", and being something of a credit card nerd, I was intrigued. I thought I wanted to go into consumer tech, but as I learned more about Brex, I found myself interested and felt like my B2B experience via Aladdin would be useful.

Tell us about your time at Brex.

I started in Operations and then moved over to the Partners and Strategy in Payments. There were big gaps in my knowledge base and I appreciated the intense learning that happened while I was there. In my second role at Brex, I loved the high-level strategy work and eventually got an opportunity to join Bond.

Can you tell us about Bond and what came next?

Bond, a banking-as-a-service startup, was looking for someone to build out their technology and strategic partnerships - I had never worked at such an early stage company (I believe it was Series A at the time) and was excited by the challenge of doing something 0 to 1. I was at Bond for about a year before moving to Airwallex.

Why Airwallex?

I wanted to move back into the payment space. I felt that there was lots of localized knowledge in payments; not a lot is written down, so my previous experience meant that I could make an impact quickly. I was also drawn to the fact that Airwallex is an established global company which was trying to enter the US. It's usually the opposite! Plus, cross-border payments are an interesting, important and challenging problem to solve.

Throughout your career, have you had any regrets and, if so, how have you managed them?

I think I was worried about general job stability. I remember talking to my parents about leaving BlackRock and them being surprised I was thinking about it. But throughout my career, I've tried to leave on a good note and maintain strong relationships through exit. Going to a startup is certainly riskier than staying at the world's largest asset manager, but I knew that I had a good background and skillset. Over time, I learned to own the risk and build confidence.

Do you think your finance background or experience helped at all in either recruiting or once you started your new role?

Yes, definitely. I think the reputation from finance – banking and real estate private equity – is meaningful. People and companies definitely respect it. In day-to-day work, what really helped are some of the intangibles: being extremely detail-orientated, confident in the numbers and able to make recommendations based on analysis.

What were some of the challenges you had to overcome while recruiting?

Startups can feel like a sh*tshow! A lot of the "secret sauce" behind the scenes is trial and error, especially for the earlier stage startups. Coming from corporate companies, sometimes you are used to just accepting broken processes for what they are. At startups, it's important to identify said inefficiencies and raise your voice when you think there's a better path. Once you treat the company as your vision (as much as any other employee's) you become a valuable candidate.

How do you find the right role?

I think it's important to be flexible. If companies aren't sure what they need, recruiters certainly won't. As long as you a) believe in mission and goal and b) believe you can learn from the team, I think you can eventually carve your own path.

Any advice for people starting this process?

Focus less on job title and think deeply about the skills you have and those that you want to build. The word "partnerships" means a million different things - regardless of what team you'd be on, make sure the mandate for your specific role excites you. And, of course, culture matters. Reflect on what you are actually looking for.

Give us your recent best: meal, book and watch.

Meal is Laser Wolf in Williamsburg, read is Pay Up by Reshma Saujani and watch has to be Is It Cake? on Netflix.

More from moneymoves

The Associate Director of CX at Dr. Squatch, shares insights into the benefits of working at startups and essentials tips for landing a job and thriving in the startup environment.

3 months ago

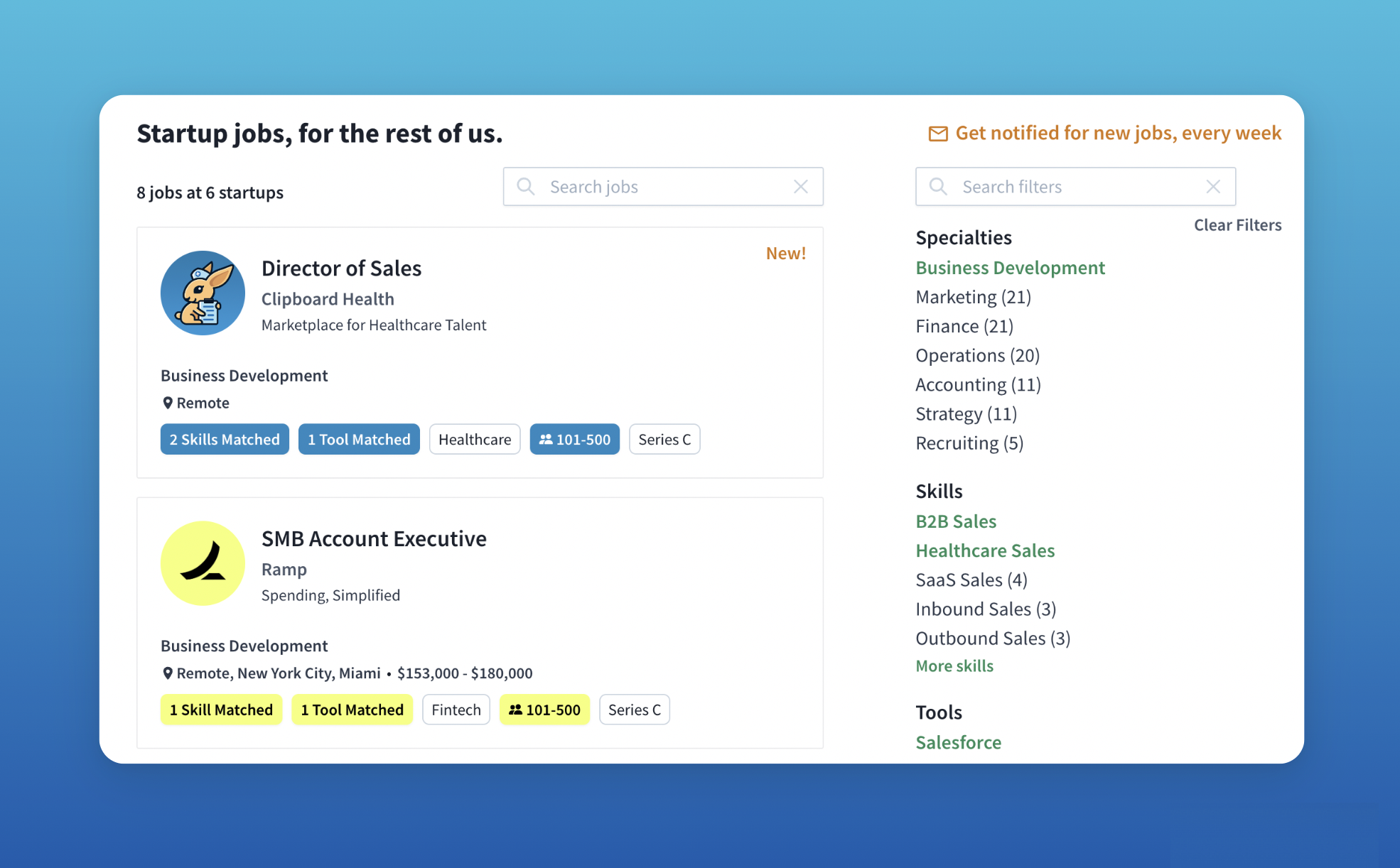

Learn more about the latest WFH-friendly opportunities from exciting startups hiring today on moneymoves.

2 months ago