Why are people leaving finance?

Exodus of finance talent, across all levels, continues unabated into tech

Finance careers were, at one point, sacrosanct. That paradigm is shifting against a background which increasingly emphasizes purpose, flexibility and work-life balance without sacrificing intellectual rigor, opportunity or compensation.

Perhaps the most famous person to make the switch is Jeff Bezos. Bezos left D.E. Shaw, where he was reporting to D.E. Shaw himself, to start Amazon in 1994. The rest is history.

While certainly not the first to make a money move from finance to technology, Bezos was a harbinger for things to come. While the dot-com bubble tempered the trend in the early 2000s, the decade ended with financiers moving en masse to technology following the Global Financial Crisis.

The steady outflow of people like Morgan Stanley investment banker Matt Wolf leaving finance continues. Earlier this year, the NY Times reported on Citigroup's Amy Wu Stratton who left her role as Director, Global Markets – Senior Markets Origination to create an online community platform dedicated to helping others. Stratton is just one example of the larger trend described by the paper:

"Up and down Wall Street, droves of bankers are changing jobs — switching banks, moving to investment firms, taking equity stakes in financial technology companies or cryptocurrency start-ups — and sometimes getting out altogether."

The 2021 leaked internal survey from junior Goldman Sachs employees leaves no reason to wonder why. Terrible working conditions, unreasonable expectations and absent support escort talent out the door.

Seeking meaningful work, personal growth and equity upside, finance talent continues to transition to tech.

More from moneymoves

The Associate Director of CX at Dr. Squatch, shares insights into the benefits of working at startups and essentials tips for landing a job and thriving in the startup environment.

3 months ago

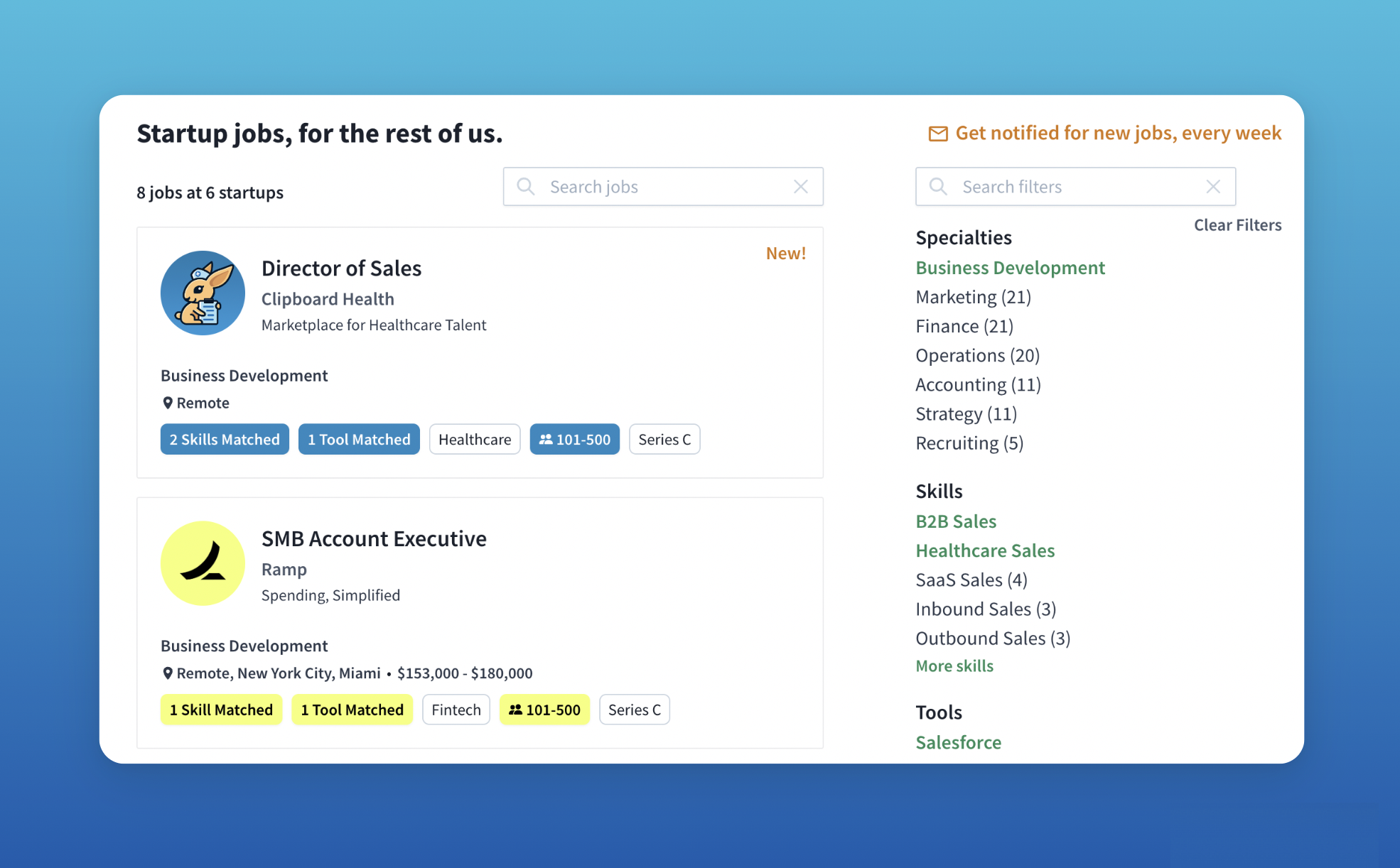

Learn more about the latest WFH-friendly opportunities from exciting startups hiring today on moneymoves.

2 months ago